Give online here.

Thank you for your interest in supporting the ministries of MBC.

Your financial support and generosity allow us to create the quality environments that you and your family enjoy on a weekly basis.

You can make one-time or recurring donations to MBC via our online portal, using your credit or debit card, or direct withdrawal from your checking account.

Other ways you can contribute to the ministry of MBC.

Online Bill Pay

Stock/Mutual fund

Legacy Giving

Most banks give you the ability to set up automatic monthly payments online. You can set this option up in the Online Bill Pay section of your online bank account.

Giving appreciated stock you’ve held for more than a year is better than giving cash. If you donate stock that has increased in value since you bought it more than a year ago, you can take a charitable deduction for the stock’s fair market value on the day you give it away without having to ever pay taxes on the increase in value of the stock. You should check with a tax professional before initiating any transfer of securities.

With the help of an advisor, you can include language in your will or trust specifying a gift to be made to Millington Baptist Church as part of your estate plan. This allows you to leave a lasting legacy while also benefiting from an estate tax charitable deduction and lower tax burden.

For more information please contact Kristie Gall.

Amazon has a program called AmazonSmile whereby they will donate one-half percent of your purchases to the eligible charity of your choice. MBC is registered as an eligible charity and you may designate Millington Baptist Church to receive the .5% donation by clicking on AmazonSmile. In order for MBC to receive credit you must use smile.amazon.com rather than www.amazon.com to make purchases. Please note that you will not receive a tax receipt for donations made via this program, as all donations are made by the AmazonSmile Foundation.

Many ways to give:

Check or cash

Make your check payable to Millington Baptist Church and put checks or cash in a giving envelope then place it in the offering plate on Sunday morning. You may also mail checks to the address below. Do not mail cash.

Millington Baptist Church

520 King George Road, Basking Ridge, NJ 07920

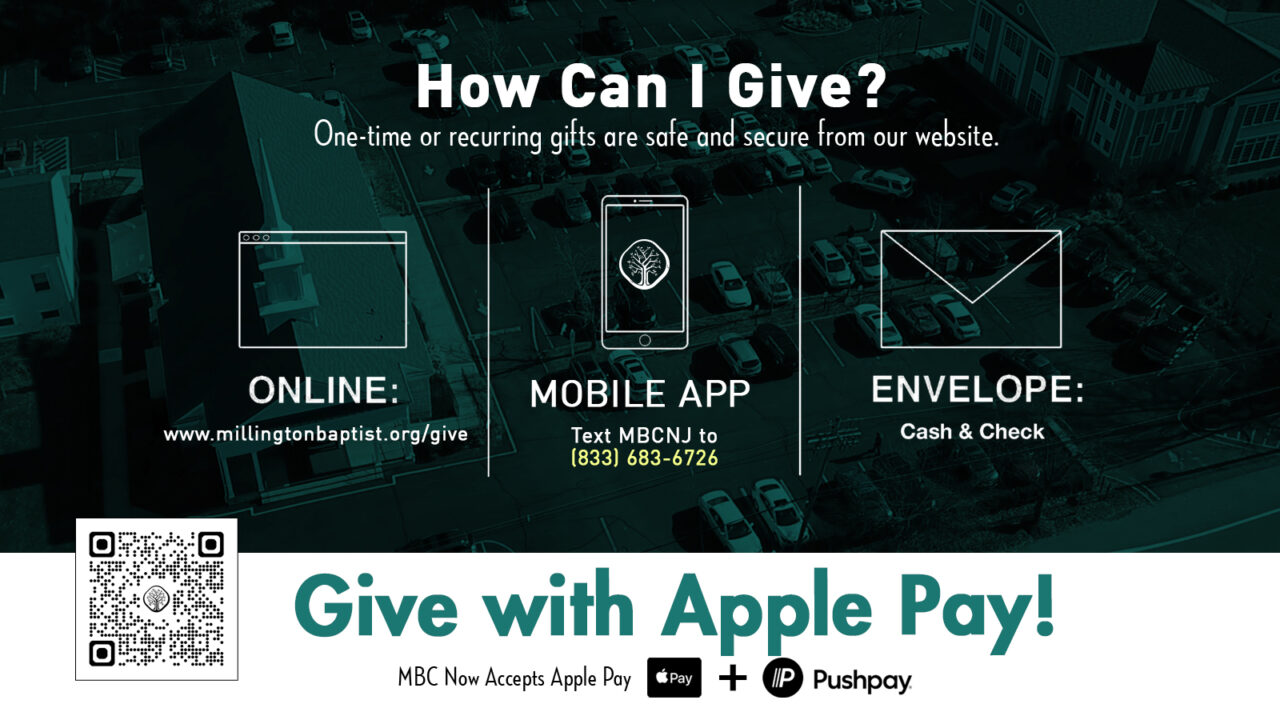

Text to give **New**

Simply text “MBCNJ” to 77977 & follow instructions. Once you set up an account, you will only need to text MBCNJ and the amount.

Online giving – Click on Give Online link

Online giving enables you to create/edit one-time or recurring gifts, allocate to a specific fund, and view your giving history. MBC pays 2.5% to 3.5% of merchant fees for each credit/debit card gift and .5% for electronic checks. Please consider using electronic check from savings or checking accounts when possible.

Your bank’s Online Bill Pay

Most banks give you the ability to set up automatic monthly payments online. You can set this option up in the Online Bill Pay section of your online bank account.

Stock/Mutual fund contribution

Giving appreciated stock you’ve held for more than a year is better than giving cash. If you donate stock that has increased in value since you bought it more than a year ago, you can take a charitable deduction for the stock’s fair market value on the day you give it away without having to ever pay taxes on the increase in value of the stock. You should check with a tax professional before initiating any transfer of securities.

Legacy Giving

With the help of an advisor, you can include language in your will or trust specifying a gift to be made to Millington Baptist Church as part of your estate plan. This allows you to leave a lasting legacy while also benefiting from an estate tax charitable deduction and lower tax burden.